(World Bank, 2020)

Barbados Welcomes YOU and YOUR Investment

Barbados is attractive to investors as a secure and reputable jurisdiction that provides strong human capital, facilitates global growth and profitability, in various sectors including international business, financial, wealth management and insurance services, global education services (private & medical schools), information & communication technology (ICT), renewable energy, medicinal cannabis, fintech and niche manufacturing, to name a few.

Our success as a centre for global business has been built on transparency, effective regulation, adherence to international best practice standards, and the attraction of businesses of substance. Additionally, Barbados is the only Caribbean jurisdiction with an established and growing Double Taxation Agreement (DTA) network that enables investors to enhance their global competitive advantage.

Barbados provides excellent infrastructure and telecommunications, educated workforce, competitive costs and tax structure and a supportive pro-business government.

Quick Facts

General Information

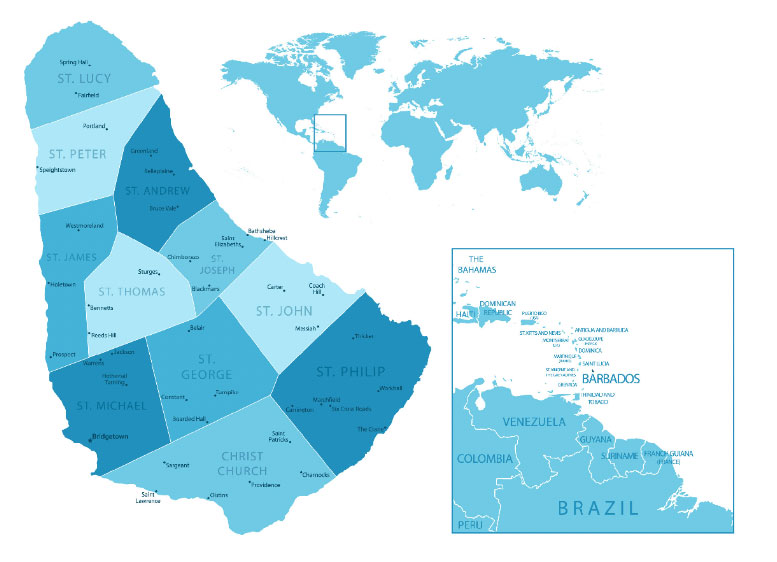

- Size: 166 sq. miles/430 sq. km.

- Capital: Bridgetown

- Government: Parliamentary Republic

- Language: English

- Time Zone: GMT – 4 hours

- Population: 269,800 (2021)

- Workforce: 114,300 (2021)

- Literacy Rate: 99.6%

- Climate: Air Temperature 22-30°C/70-90°F

- Relative Humidity: 60-70%

- Currency: Barbados Dollars (BDS$) BDS$ 2.00 – US$ 1.00

- Major Trading Partners: CARICOM, USA, UK, Canada, Germany, Japan

Key Economic Indicators

- Gross Domestic Product: US$4.8B

- GDP per capita: US$15,100

- Unemployment Rate: 8.4% (2022)

- Average Inflation: 3.0%

Geography

Geography

Barbados is the most easterly of the Caribbean islands, located where the Caribbean Sea meets the Atlantic Ocean. Its nearest Caribbean neighbours are St. Vincent and St. Lucia. Barbados is approximately 1,600 miles south-east of Miami, Florida in the USA.

The Caribbean hurricane season normally runs from June to November. However, Barbados seldom experiences the direct impact of hurricanes given its geographical location outside of the typical hurricane path.

Economy

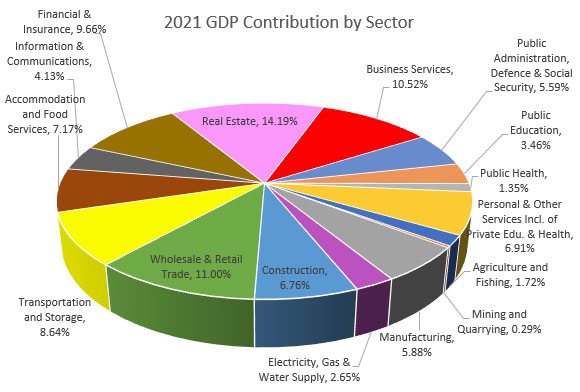

The four main sectors contributing to the country’s GDP are real estate, wholesale and retail trade, business services and financial and insurance services. Other sectors contributing to GDP include transportation and storage , tourism, private education and health, manufacturing and public administration, defence and social security.

New and emerging subsectors are actively being developed and pursued including, medical tourism, medicinal cannabis, digital technologies, global education, research & development, biotech, renewable energy, life sciences and agri-business.

Why Invest in Barbados

Here’s why:

- A business-friendly environment for businesses of substance, with a pro-investment Government

- A long history of political and social stability, with a legal system based on English common law

- English speaking and a well-educated work force and an available pool of experience and qualified industry professionals

- Modern telecommunications infrastructure, reliable utilities and a robust fibre optic high-speed internet

- Excellent physical infrastructure with an international airport and modern seaport for facilitating quick and efficient business

- An expanding international treaty network, ensuring clarity and straight-forward tax considerations

- Similar time zones and nearshore location to Eastern North America

- Excellent quality of life that includes world-class sporting events, exquisite local dining, excellent education system, good health system and more, makes it an attractive place to live, work and enjoy.

Investment Incentives

- Foreign Currency Permit: Entities that earn 100% of their income in foreign currency, are entitled to receive a Foreign Currency Permit. Holders of a Foreign Currency Permit benefit from exemption from exchange control, exemption from property transfer taxes on transfers of shares or quotas.

- Duty free concessions: Some industries such as ICT, manufacturing, renewable energy and tourism have specific duty-free concessions on imports, tax exemptions, training grants etc.

- Tax losses: Tax losses brought forward and available for offset are restricted to 50% of taxable income in any income year.

- Foreign tax credits: Tax paid to a foreign country may be credited against tax payable in Barbados, provided that the credit does not reduce the tax payable in Barbados to a rate of less than 1% of the tax payable in that income year.

- Double Taxation Agreements: These agreements offer reduced withholding tax ranging from 0-15%. Barbados has an expanding treaty network with 40 Double Taxation Agreements with countries including Canada, China, Cuba, Mexico, the UK and the USA.

- Competitive tax rates: Companies operating in Barbados benefit from a maximum tax rate of 5.5% on taxable income.

- Allowances: Annual capital, renewable energy and research & development allowances are provided under the Income Tax Act

- Capital Gains Taxes: Capital gains either on property or securities are not subject to tax in Barbados

Economic Substance Requirements

Economic substance is a G20/OECD global initiative that requires companies to demonstrate that the profits they register are commensurate with their economic presence and activities in the jurisdiction in which they reside. The Companies (Economic Substance) Act 2019-43 requires resident companies engaged in “relevant activities” to satisfy an economic substance test. The following are the relevant business activities and requirements of the test that must be met:

Relevant Activities

- Banking

- Distribution and service centres

- Finance and leasing

- Fund management

- Headquarters

- Holding companies

- Insurance

- Intellectual property holding

- Shipping

Economic Substance Test Requirements

- The entity must be managed and controlled in the jurisdiction

- The core income generating activities (CIGA) must be undertaken with respect to the relevant activity in the jurisdiction

- The company should have:

- adequate physical presence

- adequate full-time employees with suitable qualifications, who can be outsourced to third party service providers within the jurisdiction but with the company maintaining an adequate level of oversight and control of the functions

- adequate operating expenditure must be incurred

It should be noted that our high level educated human resources make it easy for companies to satisfy the substance test requirements. Click here for further information on economic substance.

Steps to Setting Up a Company in Barbados

The first steps in establishing a company in Barbados is the legal registration and incorporation of that company. It is advised that legal advice be sought to inform on company formation and external registration. Below are the requirements for establishing entities in the following categories:

- Regular Business Company or Society with Restricted Liability

- Unincorporated Business

- External Company

Requirements for Establishing a Regular Business Company and Society with Restricted Liability

The two main structures used for establishing a company in Barbados are the Regular Business Company (RBC) and the Society with Restricted Liability (SRL). The RBC, also referred to as a domestic company, is created under the Companies Act Cap. 308. The SRL established under the Societies with Restricted Liability Act is similar to what is known in the USA as a Limited Liability Company (LLC), and this structure is mainly used by US companies.

The procedure for establishing/incorporating an RBC and SRL is as follows:

- Registration of the business name (a minimum of three corporate names in order of preference)

- Incorporation of the business - Enlist the help of an attorney to complete and submit articles of incorporation/organisation documents to the Corporate Affairs and Intellectual Property Office (CAIPO)

- If 100% of the entity's earnings will be in foreign currency, simultaneously submit an application for a foreign currency permit (FCP) to the International Business Unit. FCP affords holders benefits, including tax exemptions.

- Companies that hold a FCP are required to retain a licensed corporate and trust services provider.

Apply to the Barbados Immigration Department for a work permit if you are not a citizen of Barbados and would like to work on the island.

+1 (246) 436-6870

https://immigration.gov.bb

immigration.department@barbados.gov.bb

Secure licences from the appropriate regulatory bodies, for example:

The Financial Services Commission for insurance companies

+1 (246) 421-2142

http://fsc.gov.bb/index.php/en/

info@fsc.gov.bb

The Central Bank of Barbados for financial institutions

+1 (246) 436-6870

http://www.centralbank.org.bb

info@centralbank.org.bb

The Barbados Medical Cannabis Licensing Authority for cannabis related projects

Tel 1 246-421-2197

BMCLA | Bmcla

Email: clo@bmcla.bb

Ministry of Energy and Business for licensing renewable energy projects

Tel 1 246-535 -500

Energy.gov.bb – Ministry of Energy and Business

The typical cost for incorporating an RBC or a SRL are as follows:

Government fees

- Approx. US$ 400

Average cost of professional fees

- US$ 1,500- US$ 2,800 (depending on the the legal structure of the company and the legal firm engaged

Requirements for Establishing an Unincorporated Business

An unincorporated business does not possess a separate legal identity from its owner(s). These types of businesses include sole proprietorships and partnerships.

- The procedure for registering an unincorporated business is as follows:

- Conduct a company name search, either online or through submission of a Name Search and Reservation form to CAIPO, listing at least two names in order of preference.

- Submit an application for registration form. Once the name is acceptable, a certificate of registration will be issued, which is valid until the principals file for cessation of the business.

Requirements for Establishing an External Company

The Companies Act defines an external company as an incorporated or unincorporated entity or other body of persons formed under the laws of a country other than Barbados.

The procedure for registering an external company is as follows:

- All external companies must first register with CAIPO to be eligible to start operations in Barbados

- Submit a statement on the prescribed form (Form 28), accompanied by the following documents:

- Statutory declaration by two directors of the company that verifies on behalf of the company the particulars (listed below) set out in the statement.

- Certified copy of the corporate instruments of the company.

- Statutory declaration by an attorney-at-law that this section has been complied with.

- Power of Attorney and Consent to act as Attorney in the prescribed form (Form 30) empowering a person named in the power and resident in Barbados to act as attorney of the company for the purpose of receiving service of process in all suits and proceedings in Barbados and all lawful notices.

N.B. All businesses, regardless of category must register the business for statutory obligations with the following:

National Insurance Scheme

+1 (246) 431-7400

https://www.nis.gov.bb

customer.service@bginis.gov.bb

Barbados Revenue Authority

+1 (246) 429-3829

https://bra.gov.bb

bramail@bra.gov.bb

The Value Added Tax (VAT) Division of the Barbados Revenue Authority

+1 (246) 429-3829

https://bra.gov.bb

bramail@bra.gov.bb

Planning & Development Department

+1 (246) 535-3000

https://townplanning.gov.bb

contact@planning.gov.bb

Investment Opportunities

FINANCIAL SERVICES

For decades Barbados has been a thriving financial services sector. Several banks and numerous high net-worth individuals seeking wealth management solutions, have chosen Barbados as their base from which to conduct their global business.

All financial institutions are licensed under the Financial Institutions Act which provides for four classes of licenses as follows:

- Class1: Commercial Banks

- Class 2: Trust Companies, Finance Companies, Merchant Banks and money or value transmissions Service Providers

- Class 3: Financial Holding Companies

- Class 4: Financial institutions qualifying for a FCP

Why Choose Barbados for Financial Services?

- Sound business legislation

- Supporting pool of experienced and qualified service providers

- Established and reliable networking infrastructure to support current financial transactions

- Globally recognised banks

- Expanding Treaty Network

- Excellent quality of life

INSURANCE

For decades, Barbados has been known as a domicile for captive insurance business, ranking among the top ten domiciles worldwide, according to Business Insurance. Canadian and USA captives account for over 70% of the total number of captives. However, Barbados’ profile as a captive jurisdiction within Latin America continues to grow and the incorporated cell company remains appealing to owners of the many privately held conglomerates in Latin America.

Insurance companies are categorised into one of three Classes with a single tax regime as follows:

| Class | Activity | Tax Rate |

|---|---|---|

| Class 1 | Companies that underwrite related party insurance business | 0% |

| Class 2 | Includes companies underwriting third party business | 2% |

| Class 3 | Insurance intermediaries such as brokers, agents and salesmen, holding and management companies, loss adjustors and assessors | 2% |

The Financial Services Commission (FSC) decides the class of license to be issued to each company.

Why Choose Barbados for Insurance Services?

- Good infrastructure including experienced management companies, banks, investment companies, auditors, and lawyers

- Cost competitive

- Appropriate regulation and governance

- Educated and experienced local workforce

- Ease of business incorporation and licencing

- Low capital & flexible solvency requirements

- No restriction on insurance business written

The following entities can also be established within the insurance industry in Barbados:

Segregated cell companies

Segregated Cell Companies (SCC) or Protected Cell Companies (PCC) can be established in Barbados as an alternative to the traditional rent-a-captive entities. SCC owners enjoy the benefits of a captive insurance company without having to form their own captive.

Incorporated cell companies

An incorporated cell company (ICC) comprises incorporated cells as part of its legal corporate structure. Like a SCC, an ICC comprises several cells, but unlike the cells of the SCC, each cell of the ICC is a separate legal entity with its own directors who may be different from those of the ICC. The following should also be noted

- An external company may be registered as an ICC or continued as an ICC in Barbados

- An existing Barbados company can be converted into an ICC

- ICCs must submit annual returns for each of their incorporated cells

- An incorporated cell may be transferred to another ICC or to a SCC. The

- latter can also transfer cells to an ICC

Separate Account Companies

These companies are used for single-policy arrangements, especially life and annuity product. The main difference from a SCC is that they do not put the core capital at risk like the SCC and they do not have multi-shareholder requirements

ICT

For decades, investors have chosen Barbados as a prime location for information and business process outsourcing and software development activities. Operations suitable for Barbados include the following:

- Contact Centre Customer and Technical Support

- Software and App Development

- Transaction Processing

- Health Insurance Claims Processing

- Credit Card Applications

- Web Application

Why Choose Barbados for ICT?

- Exemption from import duties on equipment used in the operations of the business

- Reimbursable training grants

- Modern telecommunications and transportation infrastructure - reliable fibre-optic network, Wi-Fi and high-speed 4G data services

- English-speaking and well-educated work force

- Dedicated competitive accommodation

- Low attrition rates

- Located in similar time zone to the US East Coast

FINTECH

Barbados gave the green light to the first blockchain start-up in the Caribbean – Bitt.com. The country has since attracted a few international fintech companies, taking advantage of the young dynamic pool of educated and available human resources. Fiber optic high-speed internet and island wide 4G LTE are reliable and provide adequate support to the sector. A regulatory sand box, a closed testing environment in which a software innovation is tested before being introduced to the market, is also available to the sector.

Why Barbados for Fintech?

- Regulatory sandbox to encourage investment and innovation

- Exemption from import duties on equipment used in the operations of the business

- Modern telecommunications and transportation infrastructure - reliable fibre-optic network, Wi-Fi and high-speed 4G data services

- English-speaking and well-educated work force

- Dedicated competitive accommodation

- Located in similar time zone to the US East Coast

- Stable political and economic environment

NICHE MANUFACTURING

Barbados offers an excellent location from which to manufacture high end products. The island is well suited for niche manufacturing production that requires a world class infrastructure including excellent air and seaport facilities, as well as an educated and skilled work force.

Why Choose Barbados for Niche Manufacturing?

- Exemption from import duties on components, raw materials and production equipment

- Capital allowances on fixed assets

- Factory accommodation in planned industrial parks, on rental or lease basis

- Preferential market access of Barbadian produced goods to various countries

- Duty free access to CARICOM countries providing the products satisfy origin criteria

- Reliable international transportation services

MEDICINAL CANNABIS

The medicinal cannabis industry is an attractive addition to the suite of investment opportunities showing great promise for the Barbados economy. The Barbados Medicinal Cannabis Licensing Authority is the regulatory body responsible for making policies, issuing licenses and regulating the sector. Opportunities available to investors include:

- Cultivation

- Processing

- R&D/Pharma

- Importation

- Exportation

- Laboratory

- Retail Distribution

- Transportation

Licenses are required for each business category, each valid for a period of five years, upon payment of stipulated fees and approval of the license application.

Why Barbados for Medicinal Cannabis?

- Unique strain due to distinct soil types and environmental conditions

- Sound regulatory standards and capacity for Research & Development - extensive research ongoing

- Reduction or exemption of import duties and VAT on inputs

- Built out support and locally derived value chains from seed to sale

- Well educated workforce

- Quality lifestyle

MEDICAL TOURISM

Often considered a high profile, mature tourism destination, Barbados attracts visitors from around the world - particularly from the UK, USA and Canada. As the demand for medical services rise, the country is well positioned to fully engage the global medical tourism industry.

Why Barbados for Medical Tourism?

- Proximity to both North and South America and historical connections with the UK

- Easy international accessibility

- High medical healthcare standards

- Skilled medical practitioners

- Quality lifestyle and a favourable climate for resting and recuperation

OTHER TOURISM OPPORTUNITIES

Other opportunities exist to invest in Barbados tourism, encouraged by progressive legislation such as the Tourism Development Act (2002) and the Special Development Areas Act that offer a range of customs duty and income tax concessions for approved tourism development projects. The following stakeholder agencies provide more information on investing in tourism:

- Ministry of Tourism and International Transport

- Barbados Tourism Marketing Inc

- Barbados Tourism Investment Inc

- Barbados Hotel & Tourism Association

Click here to access the BLUE BOOK that presents investment opportunities in Barbados

MEDICAL SCHOOLS

Barbados’ appeal as an ideal location for global education is due in part to its warm and welcoming environment, coupled with being a very safe, socially and politically stable country. This, along with its modern infrastructure, including a world class fibre optic telecommunications network and international air connectivity, as well as an excellent quality of life, contribute to the country’s ability to support the needs of an expanding education sector. Presently Barbados has four (4) medical schools on Island.

Why Barbados for Medical Schools?

- Warm and welcoming environment for students and educators

- Modern physical infrastructure, including world class fiber optic telecommunications network

- Easy international accessibility to North America and Europe

- Well educated workforce – global educational institutions are able to meet their human resource needs locally

RENEWABLE ENERGY

Renewable energy is one of Barbados’ fast-developing sectors. The Barbados Government has placed great emphasis on reducing its reliance on fossil fuels, setting 2030 as the year when the country will generate 100% of its energy from alternative/renewable energy sources. The business opportunities that can be explored within the renewable energy sector include:

- Renewable energy systems (Solar P.V., wind turbines, hydro systems, wave and tidal systems, etc.)

- Energy storage (Currently of greatest need)

- Energy saving devices

Why Barbados for Renewable Energy?

- A tropical island that can capitalise on alternative energy sources such as Solar PV, wind, waste to energy and wave

- Knowledgeable human resources who are trained in photovoltaic installations and maintenance at local institutions

- Reduction or exemption of import duties and VAT on inputs

- Tax holiday of 10 years for developers, manufacturers, or installers of renewable energy systems and energy efficient products

- Other incentives including incentives for research & product development

BIOSCIENCE

Barbados remains fully engaged in the rapidly expanding bioscience sector. The country is committed to capitalising on the opportunities that abound globally, as the jurisdiction seeks to strengthen its bio pharma, life sciences, research and development and medical device manufacturing capacity. Presently Barbados is home to Lenstec- the only medical device manufacturer of intraocular lenses in the English-Speaking Caribbean, and also to the leading in-vitro fertilisation centre in the Americas, Barbados Fertility Centre, with success rates surpassing the USA & UK.

The following investment opportunities exist:

- Medical device manufacturing

- Pharmaceuticals manufacturing

- Vaccine manufacturing

- Bio-agriculture

- Biotechnology

- Alternative medicine and wellness

- Diagnostics, molecular diagnostics

- Digital health

- Medicinal Cannabis

- Research & Development

Why Barbados for Bioscience

- Ready pool of talent within life sciences

- Excellent infrastructure with an international airport facilitating direct flights to North America, Europe and Latin America and a modern seaport

- Sound ICT infrastructure with island-wide 4G LTE and fibre optic high-speed internet

- Impressive track record – home to leading medical device manufacturing, R&D and IVF companies

- High quality of life that will attract and retain key talent

- Plans in train for the development of a life sciences park

SHIPS’ REGISTRATION

The Barbados Maritime Ships Registry (BMSR) is an attractive option for several internationally owned vessels desirous of flying the Barbados flag, including tankers, bulk carriers, container ships and yachts at competitive initial registration and annual fees, as well as low-cost annual Flag State inspections. Read more on ships registration.

Barbados Welcomes HNWIs and Digital Nomads

HIGH NET WORTH INDIVIDUALS

Qualifying High Net Worth Individuals and entrepreneurs seeking to reside in Barbados can take advantage of the Special Entry Permit (SEP) programme which allows persons the opportunity to reside in Barbados and travel freely for the duration of the permit. Such persons are taxed at a maximum rate of 35% on income earned in Barbados and on any foreign income remitted to Barbados. However, they may be able to reduce their effective tax rate via a tax credit on foreign currency earnings available to residents of Barbados. The SEP is granted on an indefinite basis to eligible HNWIs aged 60 and over, while those under the age of 60 may be granted a permit for a period of five years at a time. Click here for further information.

REMOTE WORKERS

The Barbados Welcome Stamp is a 12-month visa for non-nationals who are resident and employed in a country other than Barbados. The visa allows persons to work remotely from Barbados and to travel to and from Barbados freely, from the date of first arrival. The Visa can be renewed for a second year. Neither Welcome Stampers nor their dependents can work or provide services to individuals or companies in Barbados. They do not pay income tax in Barbados and therefore are required to pay taxes in the country in which they are tax resident. Click here for more information on the Barbados welcome stamp

How Can We Help You?

Invest Barbados is the economic development agency of the government of Barbados responsible for landing, facilitating and sustaining international investment for Barbados and helping to develop and manage the Barbados Brand.

Our Services

- Promoting and landing foreign direct investment

- Providing relevant, timely, current, quality information to investors

- Ensuring that the Barbados environment is conducive to foreign direct investment

- Introduction and ongoing liaison with relevant government agencies

- Customised client aftercare services

Head Office

Invest Barbados

Trident Insurance Financial Centre

Hastings, Christ Church

Barbados, BB15156

Tel: 1-246-626-2000

Fax: 1-246-626-2099

E-mail: info@investbarbados.org

From Barbados: (246) 626-2000

From Canada: 1-647-977-5996

From the USA: 1-347-433-8942

From the UK: +44 (0) 203-318-9036

Website: www.investbarbados.org